Often, the fees associated with SDIRAs might be bigger and much more difficult than with an everyday IRA. It is because on the elevated complexity connected to administering the account.

Should you’re looking for a ‘established and neglect’ investing strategy, an SDIRA in all probability isn’t the best choice. Simply because you are in total Regulate above every investment created, It can be your choice to carry out your very own homework. Remember, SDIRA custodians usually are not fiduciaries and cannot make tips about investments.

Compared with stocks and bonds, alternative assets are frequently more challenging to sell or can have rigorous contracts and schedules.

And because some SDIRAs such as self-directed common IRAs are subject matter to necessary minimum distributions (RMDs), you’ll really need to prepare ahead to ensure that you may have adequate liquidity to fulfill The principles established from the IRS.

The tax strengths are what make SDIRAs desirable For lots of. An SDIRA can be the two regular or Roth - the account type you select will rely mostly with your investment and tax tactic. Check out together with your money advisor or tax advisor if you’re unsure that is greatest in your case.

Introducing cash on to your account. Keep in mind that contributions are matter to once-a-year IRA contribution restrictions established by the IRS.

Shifting cash from 1 style of account to a different sort of account, which include moving resources from the 401(k) to a traditional IRA.

IRAs held at banking institutions and brokerage firms present limited investment selections to their clientele simply because they do not have the experience or infrastructure to administer alternative assets.

No, you cannot put money into your individual organization having a self-directed IRA. The IRS prohibits any transactions in between your IRA plus your personal business simply because you, because the operator, are deemed a disqualified individual.

Range of Investment Selections: Make sure the supplier permits the kinds of alternative investments you’re keen on, such as real estate, precious metals, or private equity.

Certainly, housing is among our shoppers’ most widely used investments, occasionally referred to as a real-estate IRA. Consumers have the option to invest in every thing from rental Qualities, commercial housing, undeveloped land, property finance loan notes plus much more.

Bigger investment possibilities implies you can diversify your portfolio over and above shares, bonds, and mutual money and hedge your portfolio against current market fluctuations and volatility.

Several traders are amazed to know that applying retirement resources to speculate in alternative assets has actually been probable since 1974. Nevertheless, most you could try this out brokerage firms and banks concentrate on providing publicly traded securities, like shares and bonds, because they deficiency the infrastructure and skills to handle privately held assets, like real estate or non-public equity.

Therefore, they tend not to advertise self-directed IRAs, which offer the flexibleness to invest in a very broader selection of assets.

Complexity and Accountability: Having an SDIRA, you've far more Regulate more than your investments, but You furthermore mght bear more responsibility.

SDIRAs are frequently utilized by fingers-on investors who will be ready to take on the dangers and tasks of choosing and vetting their investments. Self directed IRA accounts can be great for buyers who may have specialized knowledge in a distinct segment industry which they wish to invest in.

Simplicity of use and Technological innovation: A user-friendly System with online equipment to trace your investments, post files, and control your account is very important.

Entrust can assist you in acquiring alternative investments with the retirement resources, and administer the purchasing and offering of assets that are usually unavailable by way of financial institutions and brokerage firms.

Criminals occasionally prey on SDIRA holders; encouraging them sites to open accounts for the goal of earning fraudulent investments. They generally idiot investors by telling them that When the investment is accepted by a self-directed IRA custodian, it needs to be authentic, which isn’t genuine. Yet again, Be sure to do comprehensive research on all investments you decide on.

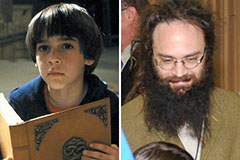

Barret Oliver Then & Now!

Barret Oliver Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!